Interest on interest can't be allowed on award until specifically provided in law or contract: SC

Court found no provision to the effect of providing interest on interest under the relevant statutes or the contract

The Supreme Court has said ordinarily courts are not supposed to grant interest on interest except where it has been specifically provided under the statute or where there is specific stipulation to that effect under the terms and conditions of the contract.

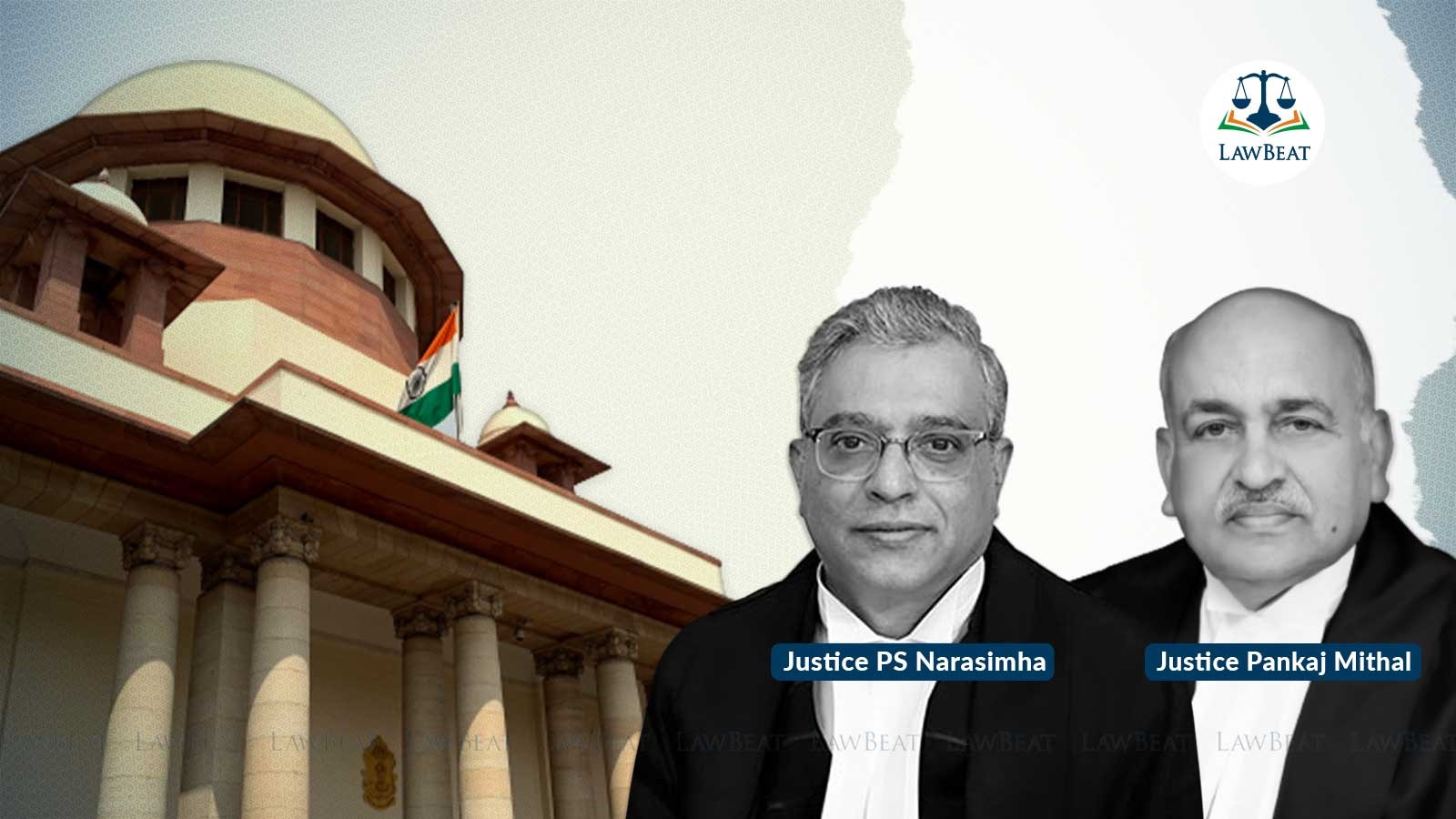

"There is no dispute as to the power of the courts to award interest on interest or compound interest in a given case subject to the power conferred under the statutes or under the terms and conditions of the contract but where no such power is conferred ordinarily, the courts do not award interest on interest," a bench of Justices P S Narasimha and Pankaj Mithal said.

The apex court dismissed an appeal filed by M/s D Khosla And Company against the High Court and the Principal Senior Civil Judge, Khambhalia, declining to grant interest upon interest for the reason that the Arbitrator had not awarded it.

In respect of a contract of 1984-85 between the Company and the respondent, the Union government, an award came to be passed by the Arbitrator on September 17, 1997, under the Indian Arbitration Act, 1940.

The award also provided for the interest on the amount awarded. The interest was awarded for two periods viz from the date of completion of the work up to the date of the award at the rate of 12% per annum (simple interest); and at the rate of 15% per annum from the date of the award till the date of its payment or the date of the court decree, whichever is earlier.

The decree of the court drawn on the basis of award revealed that interest had been awarded in two parts on the amount of Rs 21,56,745, i.e. 12% per annum on the awarded amount up to the date of award; and 15% per annum from the date of award till the realisation of the decretal amount.

Before the apex court, the Company argued that 12% interest per annum awarded for the pre-award period was part of the principal sum and it had lost its character as a separate interest. Therefore, 15% interest per annum awarded for the post-award period was both on the principal sum and the 12% interest inclusive.

The Union government said there was no controversy with regard to the power of the arbitrator to award interest on interest or compound interest in a given case. However, it cannot be paid to the claimant until and unless it is specifically granted by the award or the order of court, it asserted.

In the case, the arbitrator had granted interest for two separate periods on the principal sum adjudged only and there was no direction that the interest for the subsequent period would be payable on the principal sum adjudged including interest for the first period, the government argued.

The court examined the issue of whether interest was payable on interest or whether 15% interest per annum awarded would be on the principal sum award plus 12% per annum interest on it for the pre-award period.

The bench referred to Section 29 of the Act which provided that the court may in the decree order interest at the rate deemed reasonable to be paid on the principal sum as adjudged by the award meaning thereby in drawing the decree, the court may order for payment of interest on the principal sum as adjudged by the award. In other words, the court cannot order for payment of interest on interest but only on the principal sum adjudged, it pointed out.

The court also noted that since the award under the Act was in the nature of a decree in terms of Section 17 of the Act, it attracted the provisions of the Code of Civil Procedure also to a limited extent namely insofar as award of interest was concerned and for the execution of the decree drawn pursuant to the award.

It also noted that Section 34 of the CPC provided that where the decree is for payment of money, the court may order interest at such rate as the court deems reasonable to be paid on the principal sum adjudged. Again, the reading of the Sub-Section (1) of Section 34 CPC would reveal that the interest is payable on the principal sum adjudged and not on the interest part of the award, it pointed out.

Similarly, the Interest Act, 1978 by Sub-Section (3) of Section 3 specifically laid down that nothing in Section 3 which permits the court to award interest should empower the court to award interest upon interest, it said.

The court thus held, "Neither the Act specifically empowers the Arbitrator or the court to award interest upon interest or compound interest nor there is any other provision which provides for grant of compound interest or interest upon interest. Even Section 34 CPC is silent in this regard whereas Sub-Section (3) of Section 3 of the Interest Act specifically prohibits the same".

Having examined the facts of the matter, the bench said, "The award and the decree nowhere specifically contemplate for awarding 15% interest per annum on the amount awarded including the interest component i.e. the pre-award interest. This could not have been done even otherwise as there is no provision to that effect under the relevant statutes or the contract."

The bench also noted no material had been placed before it or as a matter of fact before any court below to show that the terms and conditions of the contract contained any such provision.

The court therefore found no reason to interfere with the concurrent opinions and declined to exercise discretionary jurisdiction under Article 136 of the Constitution.

Case Title: M/s D Khosla And Company v UOI