Drawer of cheque not authorised signatory liable to pay interim compensation under NI Act: SC

The top court held that the high court’s decision to interpret 'drawer' strictly as the issuer of the cheque, excluding authorised signatories, is well-founded

The Supreme Court has said the role of the drawer of a cheque in a company is distinct from that of an authorised signatory, who can't be forced to pay interim compensation under Section 143A of the Negotiable Instruments Act.

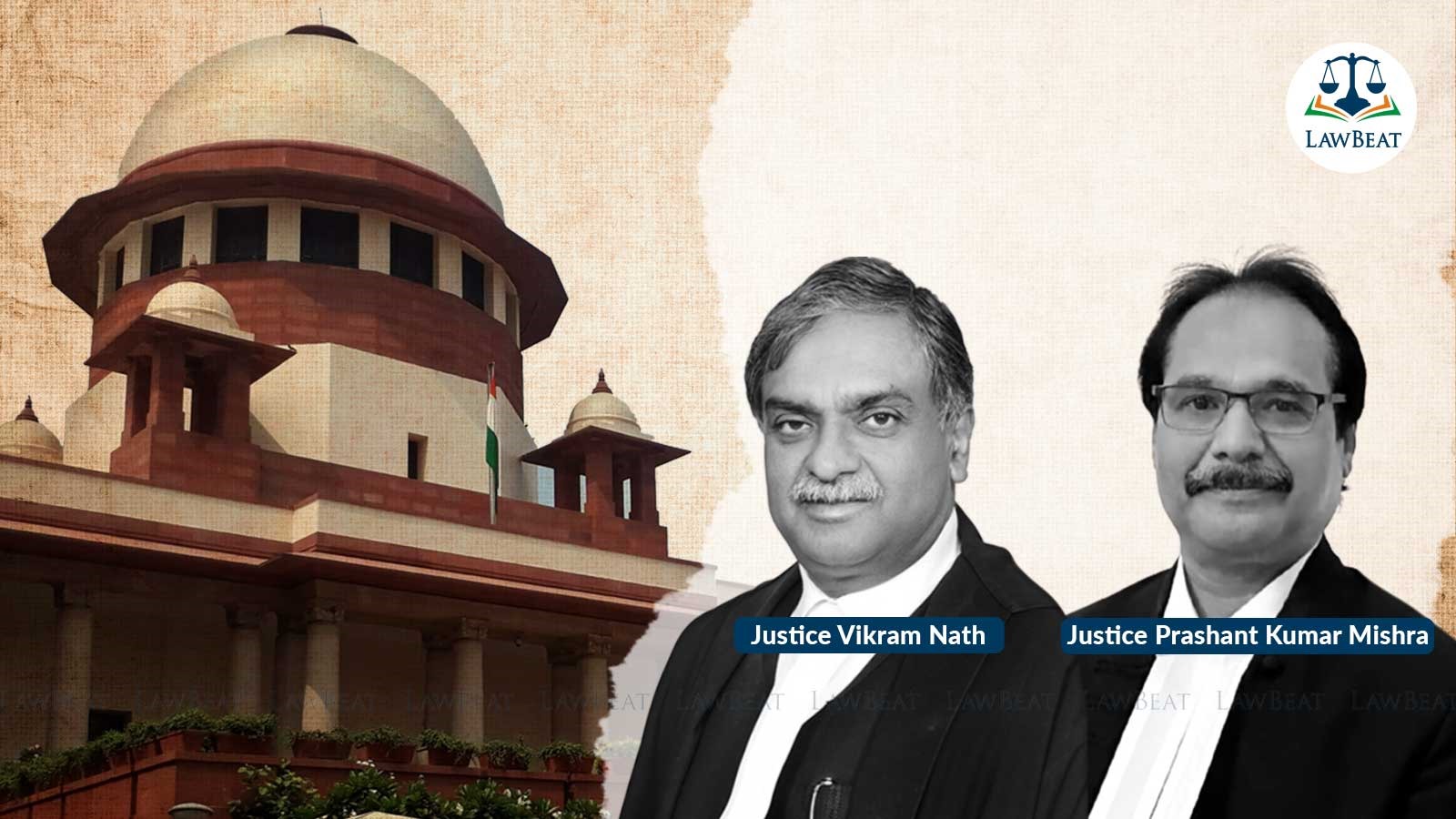

A bench of Justices Vikram Nath and Prashant Kumar Mishra agreed to argument that the primary liability for an offence under Section 138 is that of the company itself and the company’s management is only subsequently and vicariously liable. Thus, it is only the company that is to be considered as the drawer of the cheque.

Consequently, a strict interpretation of Section 143A would mean that it is only the drawer-company’s liability to pay the interim compensation as the provision does not provide for interim compensation to be paid by the employees or the management or the signatory of the company, the court noted.

Court dismissed an appeal filed by Shri Gurudatta Sugars Marketing Private Limited against the Bombay High Court's order allowing a criminal revision by respondents Prithviraj Sayajirao Deshmukh and others.

The high court had set aside a judicial magistrate's order directing the interim payment under Section 143A, Negotiable Instruments Act, 1881 to be paid by the respondents – directors of the company on whose account the dishonoured cheque was drawn.

The dispute arose out of the failure of Cane Agro Energy (India) Ltd to supply the ordered quantity of sugar, following a payment advance of Rs 63.46 Cr by the appellants in terms of an agreement. Subsequently, cheques drawn by the respondent who is chairman of the company for refund got dishonoured, leading to criminal proceedings.

The respondents, in their defence, cited the moratorium imposed under the Insolvency and Bankruptcy Code.

The matter reached the high court, which dealt with the questions of whether the signatory of the cheque, authorised by the "Company", is the "drawer" and whether such signatory could be directed to pay interim compensation in terms of section 143A, NI Act, leaving aside the company.

The high court, in its judgment, held the signatory of the cheque is not a ‘drawer’ in terms of Section 143A, NI Act and cannot be directed to pay interim compensation under Section 143A.

After hearing the parties, the bench upheld the high court's decision and rejected the appellants' contention, saying the judgment maintained the clarity and consistency of the law regarding cheque dishonour cases, ensuring that liability is appropriately assigned to the responsible parties under the NI Act.

The apex court said the high court's interpretation of Section 7 of the NI Act accurately identified the "drawer" as the individual who issues the cheque.

"This interpretation is fundamental to understanding the obligations and liabilities under Section 138 of the NI Act, which makes it clear that the drawer must ensure sufficient funds in their account at the time the cheque is presented," the bench said.

The court rejected the appellants' argument that directors or other individuals should also be liable under Section 143A, saying it misinterpreted the statutory language and intent.

The primary liability, as correctly observed by the high court, rests on the drawer, emphasising the drawer's responsibility for maintaining sufficient funds, it said.

"The general rule against vicarious liability in criminal law underscores that individuals are not typically held criminally liable for acts committed by others unless specific statutory provisions extend such liability. Section 141 of the NI Act is one such provision, extending liability to the company's officers for the dishonour of a cheque," the bench said.

The court termed the appellants' attempt to extend this principle to Section 143A, to hold directors or other individuals personally liable for interim compensation, as unfounded.

The high court rightly emphasised that liability under Section 141 arises from the conduct or omission of the individual involved, not merely their position within the company, it said.

"The distinction between legal entities and individuals acting as authorised signatories is crucial. Authorised signatories act on behalf of the company but do not assume the company's legal identity. This principle, fundamental to corporate law, ensures that while authorised signatories can bind the company through their actions, they do not merge their legal status with that of the company," the bench said.

This distinction supports the high court's interpretation that the drawer under Section 143A refers specifically to the issuer of the cheque, not the authorised signatories, it pointed out.

The court said the appellants' argument for a broader interpretation to include authorised signatories under Section 143A contradicted this principle and would lead to an unjust extension of liability not supported by the statutory text.

The bench further said the appellants' interpretation conflated the roles of authorised signatories and drawers, which are distinct under the NI Act.

The court finally held the high court’s decision to interpret 'drawer' strictly as the issuer of the cheque, excluding authorised signatories, is well-founded.

"This interpretation aligns with the legislative intent, established legal precedents, and principles of statutory interpretation. The primary liability for an offence under Section 138 lies with the company, and the company’s management is vicariously liable only under specific conditions provided in Section 141," the bench said.

Case Title: Shri Gurudatta Sugars Marketing Pvt Ltd Vs Prithviraj Sayajirao Deshmukh & Ors